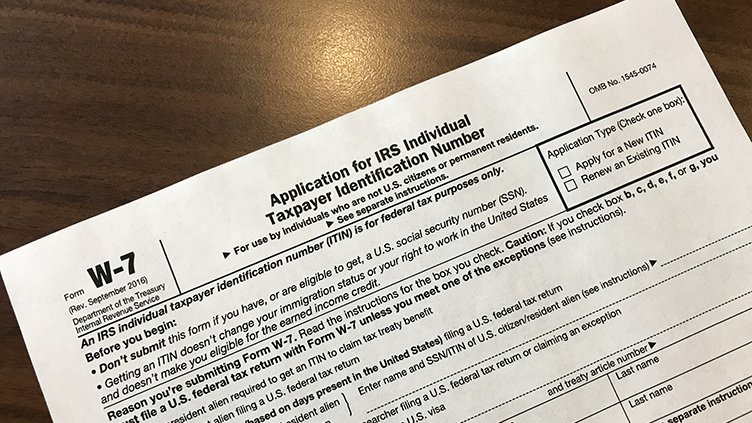

INDIVIDUAL TAX IDENTIFICATION NUMBER (ITIN)

Step 1: Consultation

Transmit Your ITIN! Call us today to walk through your case for free. Once we have an understanding, we can help you book a consultation to start your application.

Step 2: Analysis

Once you have booked your appointment and have talked to our certified acceptance agent we can get started with your application. The application requires you to file your taxes if it’s your first time and to bring valid documentation. If you are renewing you must just bring the valid identity documents.

Step 3: Finalize

Once you have consulted with our certified acceptance agent and the documents have been mailed out you just have to wait to receive your number which takes 7-11 weeks.

-

An Individual Taxpayer Identification Number (ITIN) is a tax processing number issued by the Internal Revenue Service. The IRS issues ITINs to individuals who are required to have a U.S. taxpayer identification number but who do not have, and are not eligible to obtain, a Social Security number (SSN) from the Social Security Administration (SSA).

-

IRS issues ITINs to help individuals comply with the U.S. tax laws, and to provide a means to efficiently process and account for tax returns and payments for those not eligible for Social Security numbers. They are issued regardless of immigration status, because both resident and nonresident aliens may have a U.S. filing or reporting requirement under the Internal Revenue Code. ITINs do not serve any purpose other than federal tax reporting.

An ITIN does not:

Authorize work in the U.S.

Provide eligibility for Social Security benefits

Qualify a dependent for Earned Income Tax Credit Purposes

-

We can assist you with your ITIN filing as Certified Acceptance Agents. We can verify your foreign status documents without you having to physically send them to the IRS.